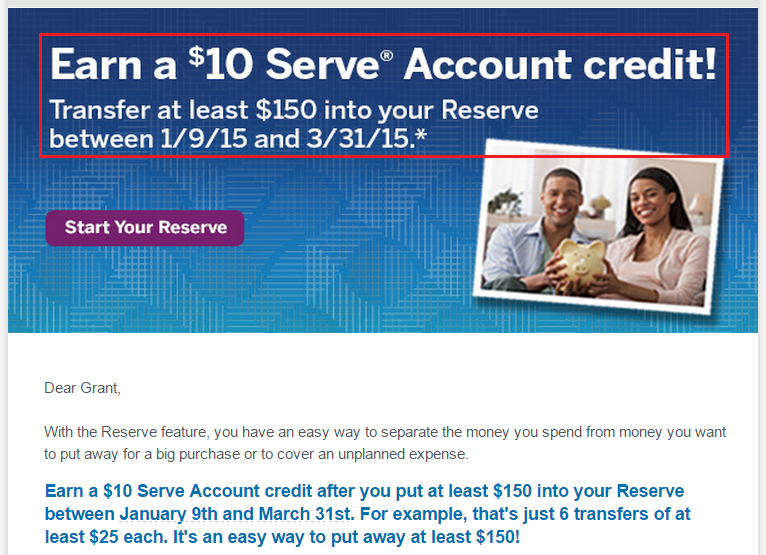

Serve sent out an email this morning promoting their Serve Reserve Account. It is basically a savings account built into your Serve Card, but you don’t earn any interest on the balance, it is more of a rainy day fund. Serve will give you a $10 statement credit if you have at least $150 deposited into your Serve Reserve Account by March 31, 2015.

Terms and Conditions:

*To receive the $10 credit from American Express Serve® you must add $150 or more to your Serve Reserve Account between January 9, 2015 and March 31, 2015 and have a balance of at least $150 in your Serve Reserve Account on March 31, 2015. Limit one (1) $10 credit per American Express Serve Account. Subaccount holders are not eligible to earn a credit. Statement credit will be posted to your American Express Serve Account within thirty (30) days of your satisfying the above requirements. Offer subject to change or cancellation at any time and cannot be combined with any other offer(s). Offer valid only for the primary recipient of this email and shall be void if transferred or forwarded.

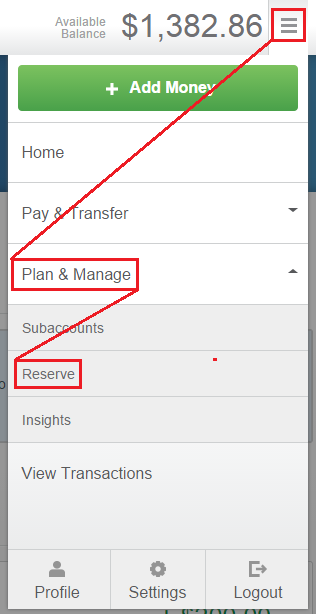

Since there is no advantage to moving the money into your Serve Reserve Account before March 31, I would wait until around March 28 and move $150 all at once into your Serve Reserve Account. You can create a Serve Reserve Account by logging into your Serve account and clicking the box in the upper right corner, then Plan & Manage, and then Reserve.

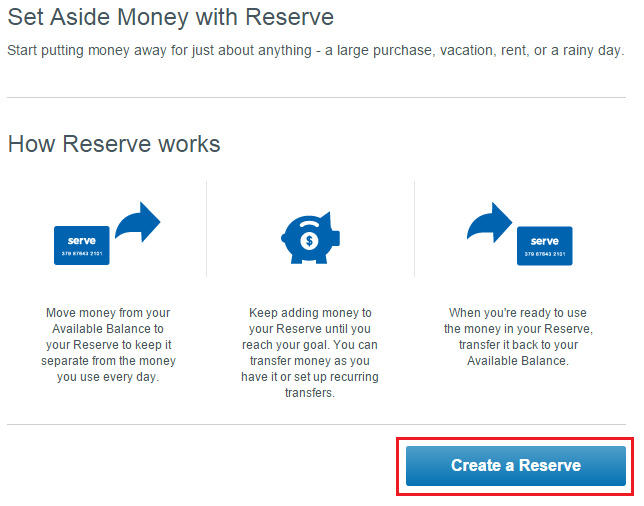

Click Create a Reserve button to get started.

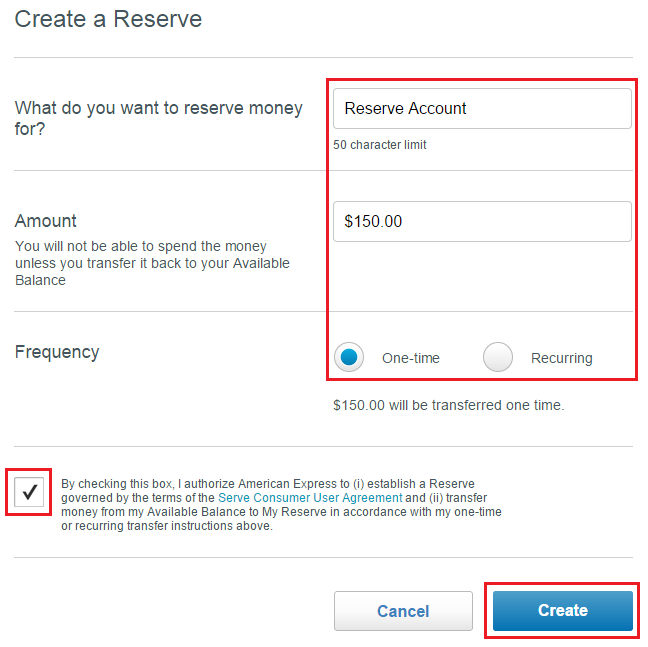

Name your Reserve Account, enter the amount of money you want to move into your Reserve Account, and select your frequency of transfer. Check the box and click the Create button. I recommend waiting until the end of March to create a Reserve Account, unless you don’t mind having the funds sit in your Reserve Account for the next 3 months.

I plan on closing my Serve Card and switching to a Redbird Card soon, so I won’t be participating in this offer. If you have any questions, please leave a comment below. Have a great day everyone!

thanks a lot. u the best!

No, you the best! I’m just ok.

I plan to close Serve and make the switch to Redbird as well. Do you have any timing in mind to make the switch? Are you making the switch mainly because of no offers from Serve/Softcard?

I might do a post about this, but the short version is that there is a Target store walking distance to my new place in Walnut Creek. I can walk in, load $2,500 in 5 minutes then walk out and not have to answer any questions or get strange looks from cashiers like I do at Walmart. The Serve offers are never very good, so I wont miss those.

As for the timing, I plan to drain my Serve Card with bill payments and then close the card. I think I have to wait 30 days before I can apply for the Redbrid Card.

Is Redbird available in CA?

Not yet, you will have to go into the wild (aka outside CA) to find a Redbird.

So assuming I get one from Arizona/Colorado, is it possible to load it from any Target register in the Bay Area?

Can you shed some light on that.

You can load your Redbird Card at any Target, City Target, or Super Target. Doesn’t matter where in the country you load the Redbird Card.

Is this a targeted offer?

I don’t think so. I’m guessing you didn’t get an email then, right? Like past Serve promos, if you participate and fulfill the requirements, you will get the bonus. If you are interested in this promo, I would participate in the promo.

I did not receive the email.

What are the upsides to Redbird? I like Serve b/c its an easy $1k spend from my house. Secondly, I have few outlets to buy GC’s using a CC (does Redbird have an auto deposit feature like Serve?). I suppose I could read the FT thread, but can you give some bullet-point pros/cons to Redbird? If I lived w/in walking distance to a Target that would entice me as well -bit outside of that, is it just a card that allows more monthly loads? I still do the Family Dollar loads on Serve when Im pushing to meet a min. spend (which is a nice option). Sell me on Redbird? ;)

You got it Scott, here is the hard sell:

– $5,000 per month in-store reload, $2,500 per day in-store reload

– You can load the full $5,000 with credit cards, debit cards, or Visa/MasterCard/AMEX gift cards (doesn’t matter if they have a PIN)

– $1,000 per month online debit card load, $200 per day online debit card load

How does that compare to your Serve Card loading?

Yeah, I moved the $150 to a “reserve” account, and then I read the fine print that the money had to be there on March 31. So I moved it back. Now I have to remember in late March to move it again. :)

I’ll send out a reminder the last week of March :)

I just wish Amex would make a Redbird app. I would like to be able to manage a Redbird account on the go. Maybe someone who has a Redbird app can talk to CS and see if its in the works.

That would be nice. I hope the Redbird app comes out soon.

Anyone get this promotional credit? When did it post?

I’m not sure, I switched from Serve to Redbird before I received my statement credit. Have you had a reserve account for at least 3 months?

Sounds like it posted shortly after promo ended. Was hoping maybe it took a while.

Hmm, not sure, sorry. There should be a few more offers in the next few months.

No problem. Didn’t get the targeted promo anyway, just hoping it was available to all.

Usually the offer is available to everyone, but not everyone receives the email. Tricky, tricky.