Pop Quiz: Chase Ink Bold Retention Bonus – 10,000 Chase Ultimate Reward Points or $95 Statement Credit?

One of my friends asked me about Chase Ink Bold retention bonuses this afternoon. I told him I asked for my $95 annual fee to be waived and Chase responded by issuing a $95 statement credit to my account (see original post). My friend told me that he was only given one retention bonus offer: spend $5,000 in 3 months and receive 10,000 Chase Ultimate Reward Points. Since that was the only offer given to my friend, he took the retention bonus. My question to you (all of you are my students, I am your sensei), if you were give the option to take a $95 statement credit or complete the spending bonus, which would you pick?

Answer now before going on…

.

. .

. . .

. . . .

. . . . .

. . . .

. . .

. .

.

Being a hard core number cruncher, I was determined to solve this problem and clearly find out which option was better. But first, I had to make some assumptions:

- I was already going to spend $5,000 over the next 3 months

- I was going to spend all $5,000 at office supply stores

- I am going to buy $200 gift cards only

- I am not going to worry about online shopping portals (no online shopping portals that I know of pay anything any more) or Visa Savings Edge calculations.

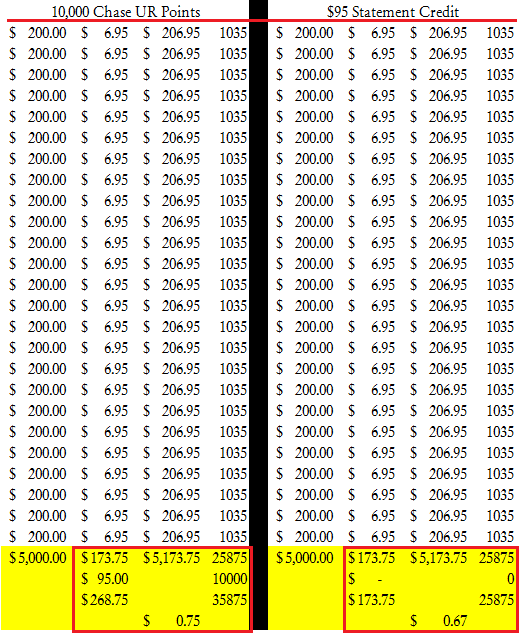

I created this spreadsheet showing my 25 $200 gift cards (25 x $200 = $5,000). I ended up paying $173.75 in gift card activation fees (25 x $6.95 = $173.75) and got 25,875 Chase Ultimate Reward Points in the process. So far so good?

For the spending bonus (left side), I added the $95 annual fee that had to be paid to the gift card activation amount for a total expense of $268.75. In return for paying the annual fee and meeting the spending bonus, I received 10,000 Chase Ultimate Reward Points, which added to my previous 25,875 equaled 35,875 Chase Ultimate Reward Points. By dividing $268.75 by 35,875, I got a price of 0.75 cents per Chase Ultimate Reward Point.

For the statement credit (right side), I didn’t have to do any extra math. I simply divided $173.75 (the total gift card activation expense) by 25,875, getting a price of 0.67 cents per Chase Ultimate Reward Point.

The reason for the difference is because you are essentially “buying” 10,000 Chase Ultimate Reward Points for $95 or 0.95 cents per Chase Ultimate Reward Point. Here is a simplified formula: (10,000 x 0.95) + (25,875 x 0.67) = $268.75 / 35,875 = 0.75

I think the reason this initially confuses people is because most people (everyone?) values 10,000 Chase Ultimate Reward Points at more than $95. Granted, you can redeem 10,000 Chase Ultimate Reward Points for $100 statement credit at the very least or $125 if redeemed for “travel”, or $150+ if transferred to Chase’s transfer partners.

You have to remember that there is a difference between the price you “buy” miles and points at (how much money does it cost to generate a mile or point?) vs. the price you “sell/redeem” miles and points at (I will sell 10,000 British Airways Avios back to British Airways in exchange for a $200 flight).

Do you agree with my reasoning, is the $95 statement credit the better choice?

If you have any questions, please leave a comment below.

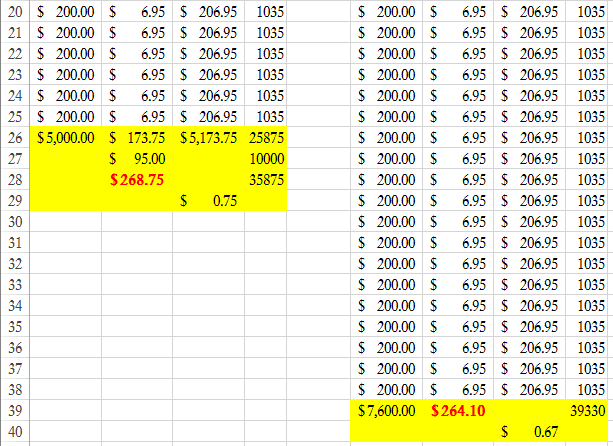

I have an updated way of proving my answer, assuming we look at the total out of pocket expense only (roughly $268 for both options). I still think I am right (right side) since you are out of pocket less and still generate more Chase Ultimate Reward Points. Any thoughts?

OK so if I take the 10k bonus point offer I would have spent $268.75 and I’d have 35,875 points. If I then redeem 9500 of those points, my net cost would be $173.75, the same as if I took the statement credit offer. But I’d have 26,375 points. So I’m not seeing why the statement credit offer is better. Why does it matter if the CPM is lower with the statement credit offer, if I end up with more points for the same amount out of pocket by taking the 10k bonus point offer?

Good point Mike, see my response of above/below about buying 13 gift cards.

I believe points will win out here, because this is an irrational endeavor. I’m not saying that people won’t crunch the numbers. But rather the value of the points is psychologically higher in that most people would rather have 10,000pts towards a Hawaii trip than $95 they can use to buy gas or groceries or use to pay part of their water bill.

My counter argument is that $95 will buy you more than 10,000 UR points. Take $95 / $6.95 gift card activation fee = 13 gift cards x 1,035 UR points = 13,455 UR points. You would get 34% more points taking the statement credit. Am I right?

You get charged a $95 fee, then get a $95 statement credit. That nets out to $0. If you want to take an unrelated $95 and go buy 13 more gift cards you can, but I’m not sure what that has to do the statement credit vs point decision.

Or get charged the $95 fee, get 10k points, redeem for $95 credit to cancel out annual fee, and you’re left with $5 or 5k points. Again you can take an unrelated $95 and go buy 13 more gift cards.

Buying additional gift cards with the $95 credit wasn’t part of the analysis or the table in the OP, only buying the initial $5k. You’re probably not wrong, but I can’t say I agree. Theoretical discussions like this usually confuse me though and it doesn’t seem there is much of a real difference between the 2 options in this case.

an easier way to put it: If you don’t value the points higher, you want to keep your OOP as low as possible, whatever reason – Worst case scenario: you take the 10k points and redeem for a $100 statement credit. Why is this $100 statement credit worse than a $95 statement credit?

Does this seem like a realistic possibility: (I was recommended this by the MS’er friend): I signed up for Ink Bold in May for the 60k bonus points after $5k spend. When it comes almost time to pay my $95 annual fee, can I sign up for Ink Plus (60k more bonus points hopefully) instead and cancel the Bold, with the rationale that I want a card that carries a balance?

Sure that is possible, I’m not sure the 60,000 point sign up bonus will line up perfectly, but the 50,000 point offer should be around.

Sorry, points win.

If you value points > $0.0095, it’s a free conversion with no effort and limitations (liquidation or $50k limit). You’re not restricted from manufacturing at 0.67 + time

If you value points < $0.0095, then convert the points to cash $100, and manufacture 5% more points for the same "cost."

You should take the points for sure, unless the $5000 in spending would prevent you from spending on another card to meet its signup bonus.

Points are worth a minimum of 1 cent each. That means the point deal is always going to be better unless you don’t plan on doing the 5k in spend in the first place.

You’re basically getting an additional 500 points for free. CPP doesn’t matter in this situation, as you’re paying less than the points cash value and there is no opportunity cost associated with it.