When I talk to friends about credit cards, they eventually always ask me how many credit cards I currently have. I am not embarrassed, so I tell them I currently have 24 open credit cards (full list here). The usual response is “doesn’t that kill your credit score?”

My favorite response is: “my credit score is good enough to get 24 credit cards, so it must be pretty good.”

But lately, I’ve been thinking about their question and I wanted to see if I can get a more accurate number for what my credit score actually is. I use free online credit monitoring services Credit Karma and Credit Sesame (learn more here).

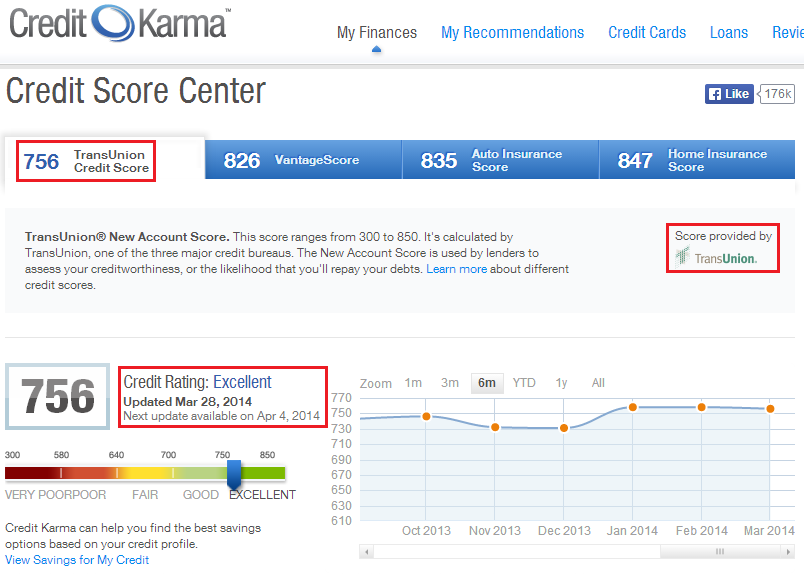

Let’s start with Credit Karma. According to their website, my “credit score” is 756 based on TransUnion Credit Score data. The reason I use “credit score” in quotes is because it is a FAKO score, not a FICO score. What that means is that Credit Karma (and Credit Sesame) get the raw credit data from one of the 3 big credit bureaus and analyses it to create their own “credit score.” Most of the time their “credit score” is very similar to the real credit score, but sometimes their are differences. One important point is to check that date that your “credit score” was produced, which in this case is March 28.

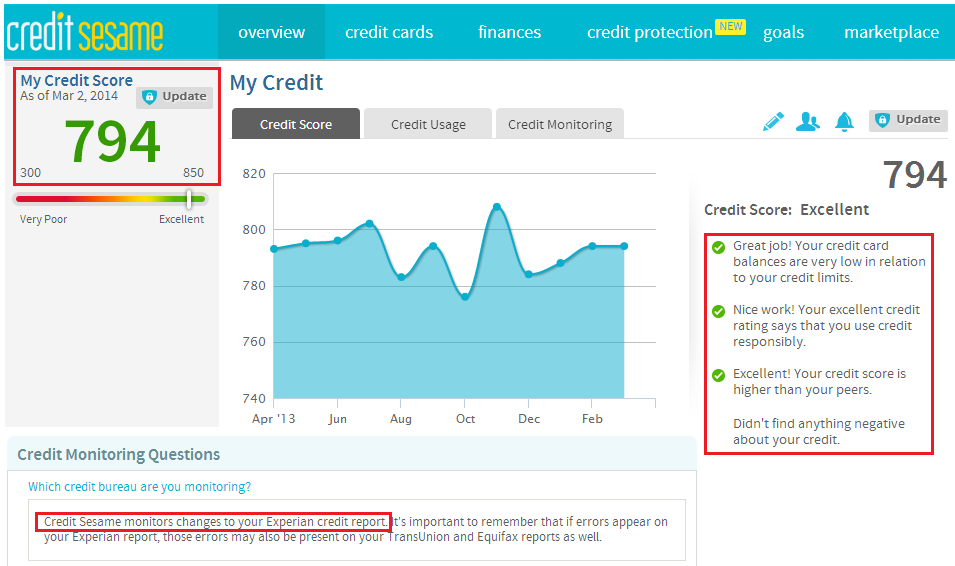

Moving on to Credit Sesame. Their website reports a 794 “credit score” as of March 2, based on information from my Experian credit report. As you can see, there is a big gap between Credit Karma’s 756 and Credit Sesame’s 794. But wait, you say. That credit score is from March 2, while the Credit Karma score is from March 28. Good catch.

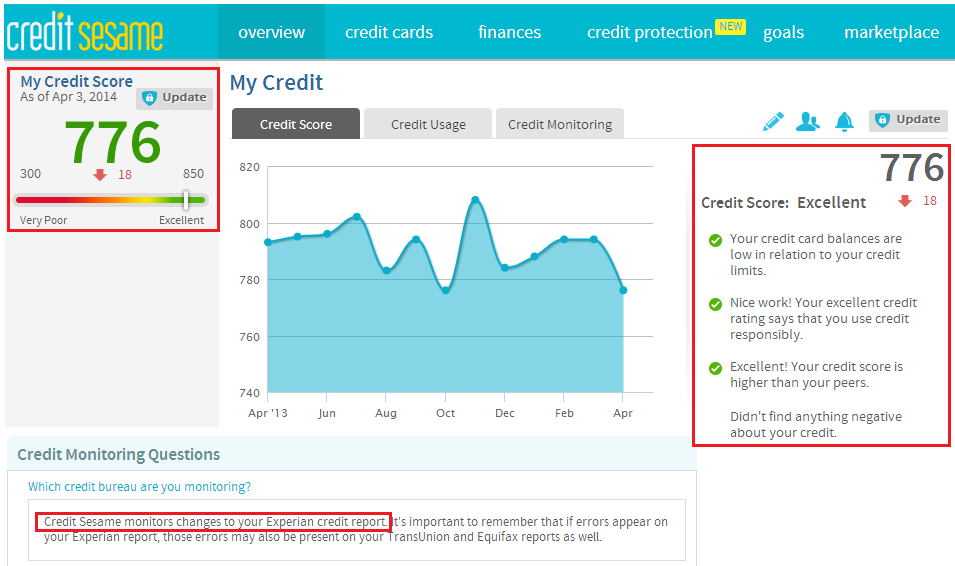

Between March 2 and April 2, I did a massive 5 card App-O-Rama (link) and Credit Sesame shows that my “credit score” dropped 18 points. Ouch! So now if we compare the new Credit Sesame score to Credit Karma’s score, the gap is much smaller (776 to 756).

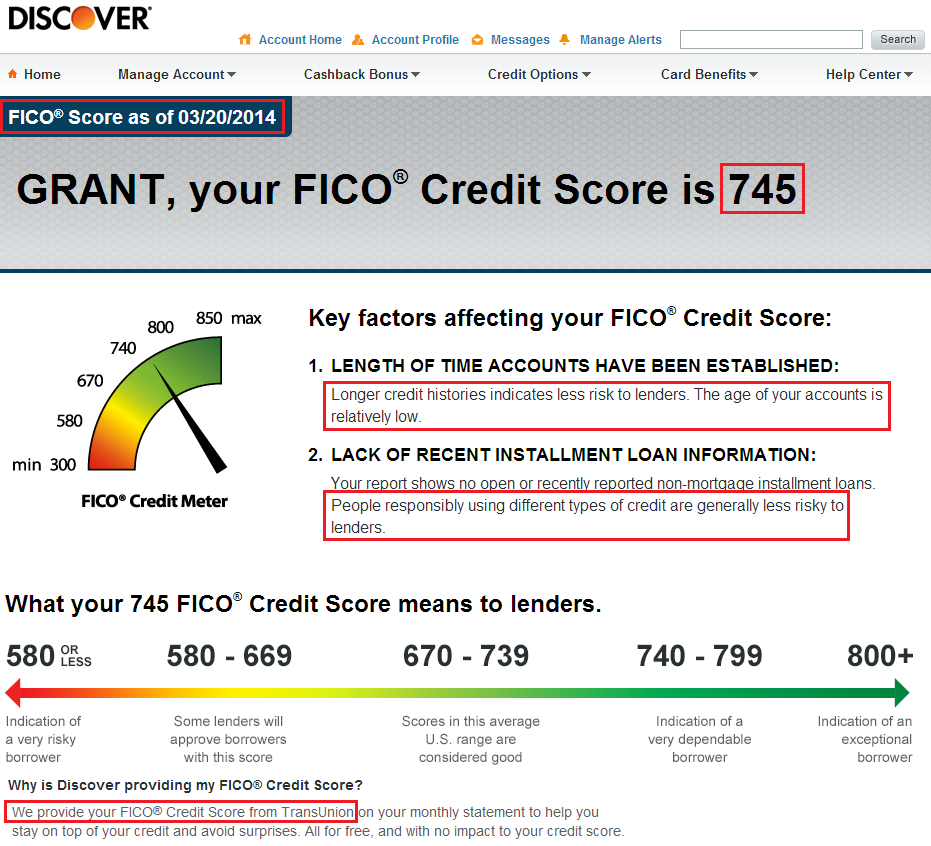

My new Discover It Credit Card that I got during my March App-O-Rama also provides my free credit score. According to Discover’s FICO Score my credit score is 745, based on data from TransUnion’s credit report. Since Credit Karma uses TransUnion also, this is a great way to compare scores. TransUnion says my “credit score” is 756, while Discover says my FICO score is 745. FICO is always preferred over any other “credit score” because FICO is the most accurate number. So, I will assume my TransUnion Credit Score is exactly 745 (as of March 20).

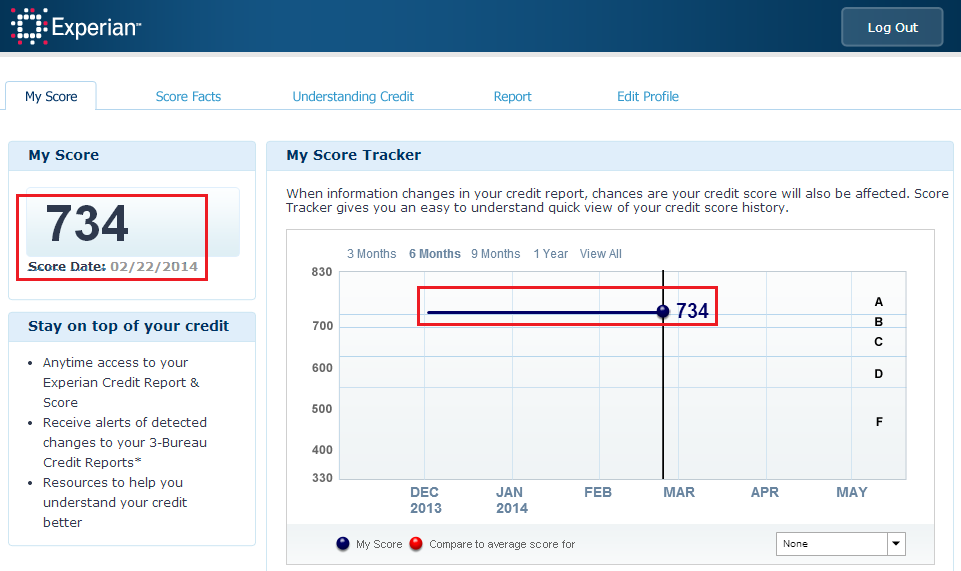

One of the perks of having the US Bank Club Carlson Credit Card is that you get free access to your Experian Credit Score every month. The only problem is that I think my account is broken. It has showed a 734 for the last 3-4 months and have not “updated” since February 22. I wish this tool would work, but as of now, it is not reliable.

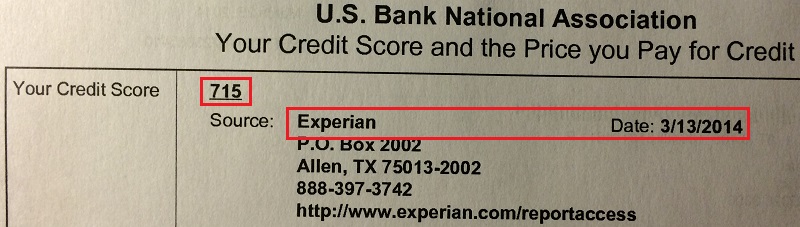

Last, but definitely not least, is a report that came with my newly approved US Bank FlexPerks Credit Card. In the report, it shows that my Experian credit score as of March 13 (day of my App-O-Rama) was 715 based on Experian’s credit data. There is no doubt that my score is down from there, but the actual decrease is unknown at this time.

So which score do you go with? Like my weight, my credit score is continuously going up and down by small increments. To make your life easier, it is best to refer to your credit score as a range between 2 scores. So in my case, I would say my credit score ranges from 715 on the low end to 745 on the high end. What does that mean? I’m not exactly sure, but like I tell my friends, “my credit score is good enough to get 24 credit cards, so it must be pretty good,” and that’s all that matters to me.

P.S. I believe Barclays offers free “credit scores” as well, but I don’t have any Barclays credit cards. They hate me, so please don’t ask me where my Barclays score is, thank you!

If you have any credit score related questions, please leave a comment below. Have a great day everyone!

The Barclay score would be the same as the Discover IT score, they both use the same FICO scoring algorithm (e.g TransUnion 2008 Classic Score).

Scores that are provided for free (e.g Barclay, FNBO, Walmart, Discover) all update whenever there is a large change to your credit score (e.g a new application). This is because the lender will do a soft pull on your credit report, so they have new data to produce a new score. I presume U.S Bank does something similar, but they use their own algorithm and not FICO.

More and more cards will come with free FICO scores in the future, it’s part of the FICO open access program and it’ll quickly become a stock standard card benefit I imagine.

Excellent, thanks for the input. I should have consulted with the Dr. of Credit beforehand.

The Danger of Teaser Rates / And buying the House First

I really love Credit Karma (although my bankers tell me their numbers are frequently off by 50 points). It helped me spot problems and learn what to do to correct them. (I thought I was an expert on my credit. A lot of years at 800+.)

I’m one of those people who buy $15,000 houses in Detroit MI, fixes them up and rents them. The problem is that there are no reasonably priced mortgages when you’re done with a $40,000 house.

So I use a line of credit and this year 0% credit cards to buy the places.

I planned to get a loan on my Oregon home to repay the credit cards before the teaser rates went BOOM! (5 more months left) . Oops. The new credit cards (at 0% for a year) crashed my 750 credit rating.

Credit Karma alerted me to the fact that using my cards above 90% pushed those numbers down to the danger zone. It will take few months (or more) to get it back up.

My bankers (and Credit Karma) tell me that the Scores look for 25%-30% use of credit cards. So I should have set up lots of cards — with $50,000 of borrowing capacity — years ago to do the $15,000 of home repairs.

Live and Learn.

The Bankers also say my score will go up 30-50 points a month when I get the balances down under 30%. It’s fixable. (One banker recommends under 25%.)

But I lost a great deal because of this.

A bigger issue they didn’t teach me in school was when starting out, buy the house before the car (if doing both within 2 years).

I represented an estate that was selling a house. The people came in to buy and could only afford $119,000 for a great house at a great price. I knew it was worth $130,000 (It’s now about $200,000). I was willing to sell for $122,000 without a realtor.

They didn’t qualify. Even though their income was over $35,000.

The Reason: Hubby had bought a $30,000 truck with $600 payments. So they could only borrow $119,000.

Home loans use different — more forgiving — ratio than autos.

If you get the house first, you can then buy the car/truck.

(Or be like me and continue to drive a beater with no payments.)