Surprise Chase Ink Plus Approval after Closing my Chase Ink Bold

Based on the responses from my recent poll (voting still open), the Chase Ink Plus seems like this is a pretty popular topic in the voting.

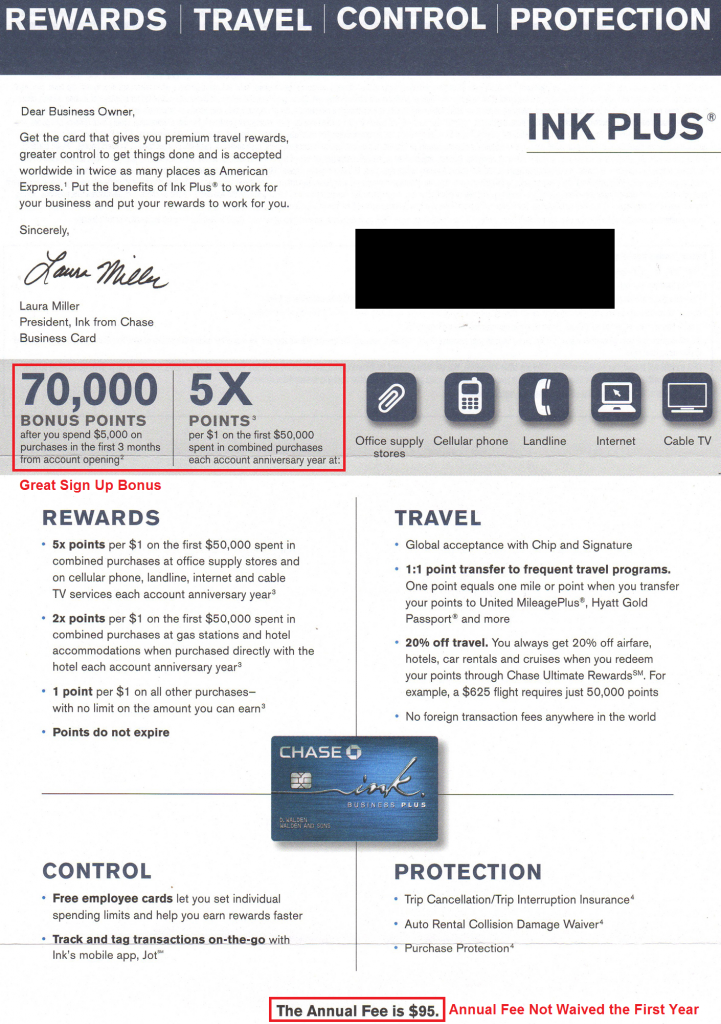

I would have shared my story sooner, but right when it happened, the sign up bonus for the Chase Ink Plus Business Credit Card raised from 50,000 to 70,000 Chase Ultimate Reward Points. I’m sure you were (are?) bombarded with posts about the Chase Ink Plus and didn’t want my story to get lost in the crowd. With that said, here are the facts:

- I got my Chase Ink Bold MasterCard in April 2012

- I got my Chase Ink Bold Visa in March 2014

- I applied for my Chase Ink Plus Visa on September 12, 2014

The reason I applied for the Chase Ink Plus Visa Business Credit Card was because I received a targeted letter in the mail for the 70,000 Chase Ultimate Reward Points sign up bonus. It was too good to resist, so I pulled the trigger.

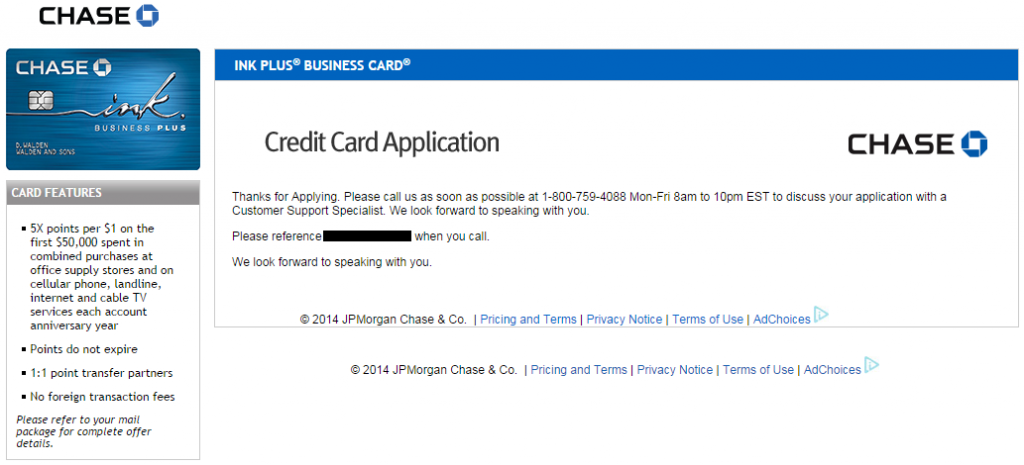

After submitting the application, I received a pending application status and called the Chase Business Reconsideration Department.

On the phone, I explained why I had 2 Chase Ink Bold cards and why I wanted a Chase Ink Plus card (flexibility to pay for purchases over time, of course!) and answered various questions about my business (last 3 years of business income and net profit). After giving her all the necessary information, she said, “I will submit your application for approval,” which in my mind essentially means, “You’re Approved!” Not so fast…

About a week later, I received an envelope from Chase. I was so exciting! Only problem was, there was no Chase Ink Plus card inside, just a denial letter. I forgot what the letter said, all I knew was that my application was denied. I called back into the Chase Business Reconsideration Department and asked what had happened to my approval. The agent was not as friendly as the first agent and she told me that she would send me a form in the mail and I would need to supply income statements and business records from the past 3 years.

I felt doomed and a little betrayed by Chase. In somewhat of a hasty/vengeful decision, I called the number on the back of my 2 year old Chase Ink Bold MasterCard and told the agent I wanted to close the card. I told him that I haven’t used this card since I got my Chase Ink Bold Visa and that “having 2 Chase Ink Bold Cards was negatively affecting my chances of getting approved for a Chase Ink Plus card.” I’m not sure if he agreed with me or thought I was crazy, but he was able to close my Chase Ink Bold MasterCard right away.

As the days passed, I was not looking forward to getting another letter regarding my Chase Ink Plus application. To my surprise, the next envelope I received from Chase had my brand new Chase Ink Plus card. I was so surprised and I had so many unanswered questions.

- What happened to the form I needed to fill out?

- Did the first reconsideration agent lie to me and not approve my application?

- Did the second reconsideration agent scare me and secretly approve my application?

- Did closing my old Chase Ink Bold MasterCard really help me get approved for the Chase Ink Plus card?

- Would I ever know what was going on behind the scenes of Chase?

At the end of the day, those questions don’t matter. As long as I got my Chase Ink Plus card, life was good. I’m not sure my story/tale/anecdote is helpful, but it is worth a shot if you get in a similar situation as me.

Looking back, I don’t recall ever getting an email from Chase telling me that my application was approved and that my Chase Ink Plus card was on its way. I think I noticed something strange going on in my Chase account (like a new business card account showing up), but I didn’t connect the dots right away.

As of today, my new Chase Ink Plus is getting a lot of action as I work toward the $5,000 minimum spend. The $95 annual fee isn’t waived the first year either, but that’s fine. As long as I get my 70,000 point sign up bonus, life is good. If you have any questions, please leave a comment below.

P.S. this is what I look like when I shop at Staples, just replace her body with mine and the shopping bags with Visa gift cards :)

Hi Grant, congrats of getting approved for Ink Plus! that’s very strange and surprising story! but all for good!

To quote what you said “On the phone, I explained why I had 2 Chase Ink Bold cards”….can you please tell me what exactly did you say as the reason for having 2 Bold cards? or if you can….please write a conversation line between you and the agent, as it would be helpful for us who will call recon line.

Thanks!

I don’t really recall what I said in this instance, but when I had to do a recon call explaining why I wanted the Chase Ink Bold Visa in addition to my Chase Ink Bold MasterCard, it was pretty simple. I said, “some of the merchants and vendors I work with do not accept MasterCard, therefore a Visa business card would come in handy.” That seemed to be good enough at the time. Now since it is not possible to get the Chase Ink Bold MasterCard, you probably won’t be able to use that explanation. Does that answer your questions? Yes, all of these cards are on the same business (my Ebay business which is turning 10 years old this December).

I love it1 Great post Grant

Thanks Lucy!

Thanks Grant, do you use two different business for Bold Visa and Mastercard? or can it be same business?

Sorry, missed your comment about “under same business”…..interesting…so do you think I can get approved if I give them same business info as I have with Bold when I am applying for Plus?

It’s possible, but it might be hard to explain why you want a Bold when you already have a Plus card.

All of my Ink Cards were for the same business and I used my SSN to apply for all three.

My guess is the business statement letter automatically went out before the reconsideration was processed. Once the reconsideration was approved, your card was sent. I have had this happen before with another card.

I still have not received the business statement letter, so I’m not sure what is going on.

i currently hv an ink plus. i use “sole propetier” and soc sec #…i would love to get a 2nd ink plus (70k) can i apply for a 2nd card with same “sole” info and be approved and receive the 70k for 2nd card? id hate to go thru hassrel if 1) i dont get approved and /or 2)i get approved and spend 5k and dont receive 70kbonus…oh and btw i have a freedom/saphire/slate and checking account in good standing with them

As far as I know, you would not be able to get a second sign up bonus because the Chase Ink Plus is the same card as what you already have and you would need to have a different business (TIN/EIN).

Hi Grant, I was considering pulling the trigger on the Ink Plus for the 70K bonus but my husband doesn’t want me to put spending on my business card that isn’t business related. There is no way I could meet that minimum spend with my small business. Do you put personal expenses on the card to help meet the minimum spend requirements? Any advise would be helpful,

Thanks.

I’m probably not the right person to answer this question since I MS on this card with Staples. I do put my AT&T phone bill and my Cox TV/Internet bill on my Ink Plus. It really depends what your business is and if you can justify putting purchases on your business card.

In casual conversation with a banker at Chase in July, I mentioned that I have had a FEIN for several years, and he reacted as though approval for any of the Chase business cards was likely. I didn’t apply at the time. Lately, I’ve seen blog reports that Chase now wants considerably greater detail about the business applying, including its actual earnings.

Hi Grant,

I applied for the Ink Plus in May 2014, the 60K promotion. I am debating whether to apply for the 50k Ink Bold before it goes away. I only have 1 hard pull from Chase in 2014, from the Ink Plus.

I would just be using my same SSN # I used for my Ink Plus, no EIN. Is this a good idea? Would I be approved? (Assuming I make the argument that I always pay on time and I decided carrying a balance will never happen)

You should be fine to apply for the Chase Ink Bold with your SSN. If you enter the same business and financial information that you used on your Chase Ink Plus application, you should be fine. If you have to call the reconsideration department, you can say that you want an Ink Bold for your smaller purchases that you will pay off at the end of the statement, but you want to keep the flexibility of the Ink Plus for larger business purchases that you may not be able to pay off at the end of the statement. Something like that should work. Good luck!

Hi Grant, came upon this post while trying to figure out what to do. My husband applied for Ink Plus recently online and got a letter saying they want 2 years of personal and business financial and tax statements. He works a regular job but we have a rental property so indicated sole proprietor and used SSN. Should he just call them up instead? Don’t really have a business financial/tax statements not do we really want to go thru all that. If we don’t proceed, will that come out as denial?? Any words of wisdom?

You should be able to calculate your business total income and total expenses for 2014 and 2015. If there is a phone number listed, call the Chase business card reconsideration department. If you do not provide this information, Chase will probably deny your application. Good luck!