Facebook Messenger Entering the MS Game with Debit Card Payments and takes on Venmo and Square Cash

(Hat tip to The Flight Deal Twitter team for the link)

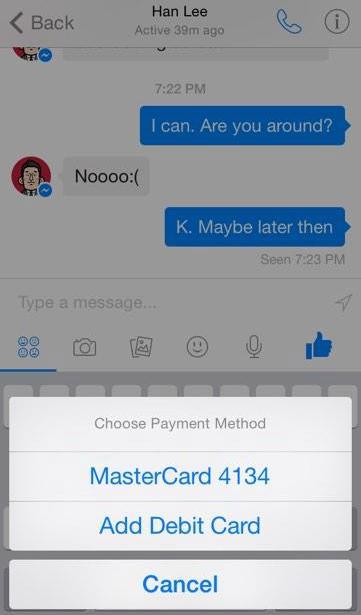

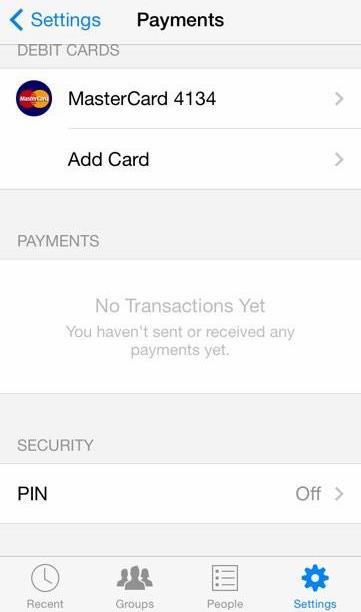

Tech Crunch, a technology website, recently posted an article called Hacked Screenshots Show Friend-To-Friend Payments Feature Hidden In Facebook Messenger (link). The article has a few screenshots showing the peer-to-peer payment platform built into the Facebook Messenger app. These features are *not yet active* and Facebook has not officially released any information about the new service.

Judging by the screenshots and the article, it appears that Facebook will allow debit cards to be used to send money from one person to another. The system sounds very similar to Venmo and Square Cash where the funds are debited from one debit card and credited to another debit card or bank account. By using debit cards, the article believes the fees associated with the transaction will be around 40-50 cents, low enough where Facebook will eat the fees for a while.

At the beginning, you could use a PayPal Business Debit Card on Square Cash to send money from one account to another and earn cash back. Unfortunately, Square changed that and now the PayPal Business Debit Card no longer earns cash back on those transactions. That also used to be the case when you could use the Paypal Business Debit Card on Evolve Money to earn cash back paying certain vendors. But then Evolve Money killed that as well.

It will be interested to see what the payment limits will be and if there will be any fees associated with the transactions. I’m sure Facebook will crackdown on people sending money back and forth with a PayPal Business Debit Card, but it will be fun to see how long it lasts.

Last but not least, if you haven’t been reading Frequent Miler’s posts from the last few days about the Prepaid Target RedCard, you really should check it out (link). The new product is only available in some states and has not reached California, so I cannot give it a try. It is run by American Express and uses the Bluebird/Serve payment system. I would love to go to my Target store than my Walmart store and hope to see the roll out reach California soon.

If you have any questions, please leave a comment below. have a great day everyone!

FB might eat the $.49-50 for a while…until the hardcore MS’ers start crushing it with it debit cards from all over creation:)))

FB has no idea what they might be getting into.

Once MSers find a niche they kick the door down and stampede it to (virtual) death.

Yes, I know this won’t last long… remember Google Wallet last year that let you send credit card payment for free? That lasted about 2 weeks :)

Google Wallet let you send credit card payments for free, but I think it was originally intended to be a promotional period. So, I don’t think frequent flyers are to blame for them introducing a fee.

The big questions about this new Facebook Messenger: what will the monthly limits be? Will Visa gift cards and One Vanillas work? It’s also a coincidence that news about Facebook Messenger was published around the same time as Amazon Payments ended, and around the same time as Apple Pay was about to be released.

Since this feature of Facebook Messenger isn’t public, I would guess that this feature will be introduced when Apple Pay is finally rolled out.

It might also have to do with why Facebook and Facebook Messenger are 2 different apps in the Google/Apple App Stores.

lasted 2 weeks..but I got a good $6,000 in spend :)

Great job, glad it was worthwhile!

regarding the new Amex card for Target, did you read the details, its on the same platform as BB so you cant have both, either way are you going to kill your Serve card to try this, I highly doubt it as Targets employees have much higher IQ than you know who store.

I will give it a try and see if I can get both. There are people that have Bluebird and Serve cards, so it might be possible. I still think the Target employees I see on a daily basis are much nicer/friendlier than Walmart.

When you hear about people that say they have BB and Serve cards, they just mean they have both cards at their disposal by using their family members information. In my situation, I have 3 Serve cards but only 1 is under my SSN.

I don’t think that there is a way for you to get both a BB and Serve account using the same SSN. The same will be applicable to the Redbird (Target Prepaid Redcard) card.

In theory, yes, but I have heard that some people have a Bluebird and a Serve card in their name with their SSN. I’m not sure how it is possible, but it is. I personally have access to 3 Serve Cards and a Go Bank Card.

Gobank card is NOT made by Amex. Gobank and Serve are NOT even similar products.

In the case of Redbird and Serve they are similar products so I can see how their system rejects you. This is why people knew they had to cancel BB account before signing up for Serve. I mean I truly hope I am wrong on this and there is some loophole to be able to sign up for the Redbird card but I just can’t see how you can get both using the same SSN.

Grant I agree w u I may want to switch over to target. Or at the least add another family member for an acct…..

There literally are 4 targets within 10-15 min of my house lol … Gotta love irvine . Although it’ll be a while before we get that chance.

And finally it’ll depend on whether loading is smooth and easy there…

I’m tempted to go to a Target store outside CA on my travels, get a Prepaid Target RedCard, and bring it back to CA. I’m sure the stores/cashiers will be more clueless than trying to load my AMEX for Target :)

Ilas for debit payment from PayPal , what’s good when we can hardly find any cvs sells PayPal my cash ?

I have no trouble buying PPMCC at CVS and other pharmacies.