More Info Regarding Chime Card Loads After October 8 and my App-O-Rama Planning

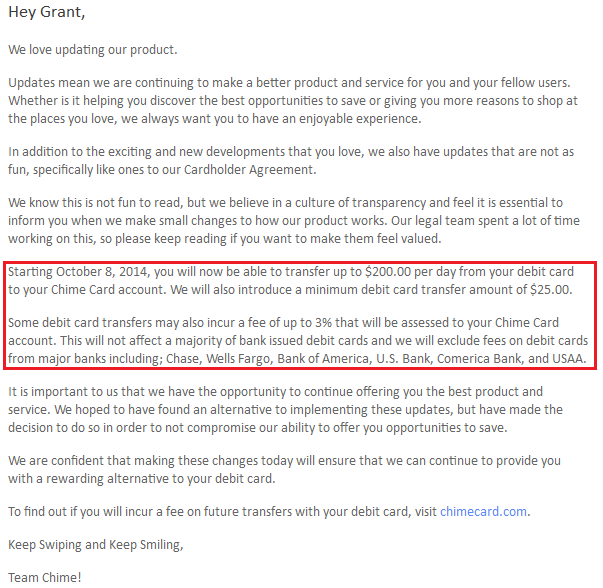

Literally a few minutes before writing this post, I received the following email from Chime regarding the previously announced changes to debit card loads (link). Starting October 8, you will be able to load up to $200 per day, with a minimum load amount of $25. If you use a debit card from Chase, Wells Fargo, Bank of America, U.S. Bank, Comerica Bank, or USAA, your debit card loads will remain free. If you use a different debit card (including the PayPal Business Debit Card), you will *most likely* get hit with a “fee of up to 3%” per load. We still need to wait and see what Chime does regarding the PayPal Business Debit Card. If you use a debit card from one of the previously mentioned banks, the October 8 change will benefit you.

My last App-O-Rama was on June 11 (link), so I will be doing my next App-O-Rama this Friday (September 12). As a refresher, here are the results from my last App-O-Rama:

- Barclays Arrival+ Credit Card – automatically denied

- Citi American Airlines Executive World MasterCard – recon call approved, $5,000 credit line and moved some credit from my Citi Dividend Credit Card

- American Express Premier Rewards Gold Charge Card – automatically approved, charge card with no preset credit limit

- Chase Southwest Airlines Rapid Rewards Plus Credit Card – recon call approved, $2,000 credit line, moved some credit from other Chase Freedom Credit Card

- US Bank Club Carlson Business Credit Card – approved after applying again in a branch (link)

- Bank of America Alaska Airlines Visa Signature Credit Card – automatically approved, but for a Platinum Plus credit card with a $2,000 credit line

It is also important to know which credit cards I have that have annual fees coming due. This helps with my reconsideration (recon) calls so I know which cards I can move credit lines from or close, if necessary. The following credit cards have annual fees coming due in November:

- Chase IHG Credit Card – keep open for annual free night certificate (going for retention call also, but have no used this card much, so probably won’t get any decent offers)

- Chase Hyatt Credit Card – keep open for annual free night certificate (going for retention call also)

- US Bank Club Carlson Personal Credit Card – keep open for annual bonus points (going for retention call also)

- Bank of America Alaska Airlines Visa Signature – may downgrade/convert to the Better Balance Rewards to get $100 cash back per year (link)

- American Express Platinum Mercedes Benz Credit Card – I really love the Priority Pass lounge card and the $200

airline gift cardsairline incidentals credit (going for retention call also) - American Express Hilton HHonors Surpass Credit Card – I already have a Citi Hilton HHonors Reserve Credit Card so there really is no reason to keep this card (I will go for retention call also)

Looking at the above list, I am heavily leaning toward keeping the first 3 and slightly leaning away from keeping the bottom 3 credit cards. but it is good to have options, no matter what ends up happening.

For my App-O-Rama, I like to go for a personal credit card from each of the credit card companies. Here are my thoughts:

- American Express – I have/had in the past most of the current credit cards and am not planning on going for any business cards. I currently have the Blue Cash Preferred but I want to get the Old AMEX Blue Cash as well. I tried to find out if it is possible to have both cards open at the same time, but have not found any results. I may move my credit line over from the Hilton HHonors Surpass Credit Card if necessary. The Old AMEX Blue Cash has interesting rewards. “On your first $6,500 in purchases made with the card: 1% cash back at gas stations, grocery stores, and drug stores, and 0.5% everywhere else. After spending $6,500: 5% cash back at gas stations, grocery stores, and drug stores, and 1% cash back everywhere else.” Please read Free-quent Flyer Book’s post for more info.

- Bank of America – since I already have 3 Alaska Airlines credit cards (personal Visa Signature, personal Visa Platinum, and business), I feel like my chances of getting another Alaska Airlines credit card are slim. Therefore, I will go the Virgin Atlantic credit card. There are a few different offers out there at the moment, but I will go for the one that offers 50,000 miles after spending $2,500 in 3 months. Apparently this offer is dead. I searched all over the web and all links lead to this page. I will pass on Virgin Atlantic for now.

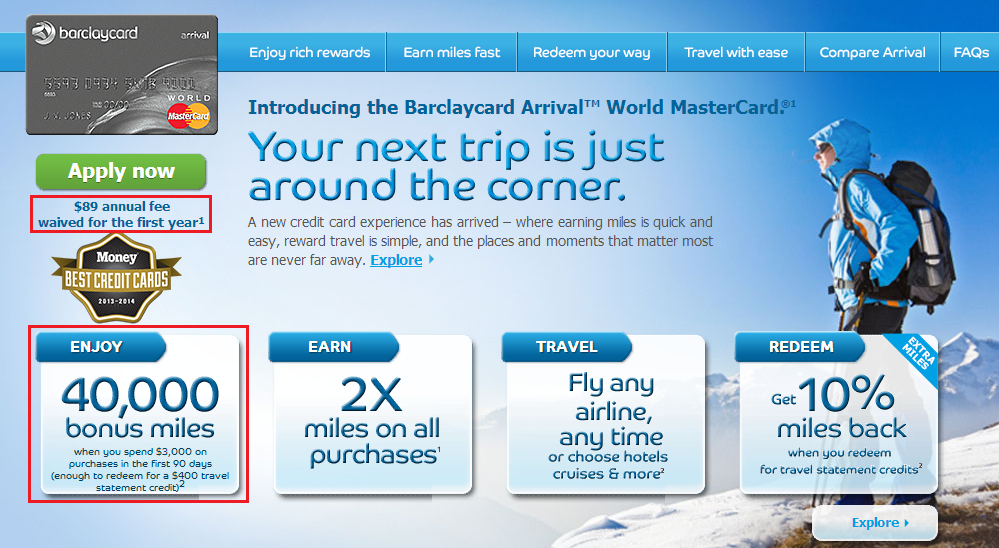

- Barclays – to this day, I have never been approved for a Barclays credit card, but that hasn’t stopped me from trying. I will go for the Barclays Arrival+ Credit Card for the 3rd or 4th time. Hopefully the credit card gods will be smiling down at me. If I get approved for the card, I will get $400 “cash back” after spending

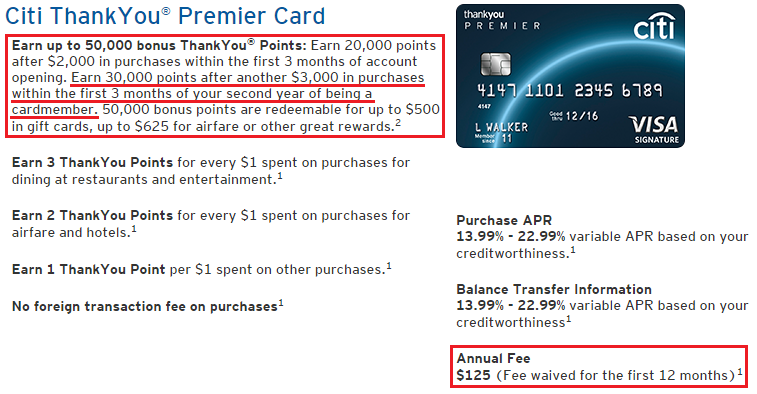

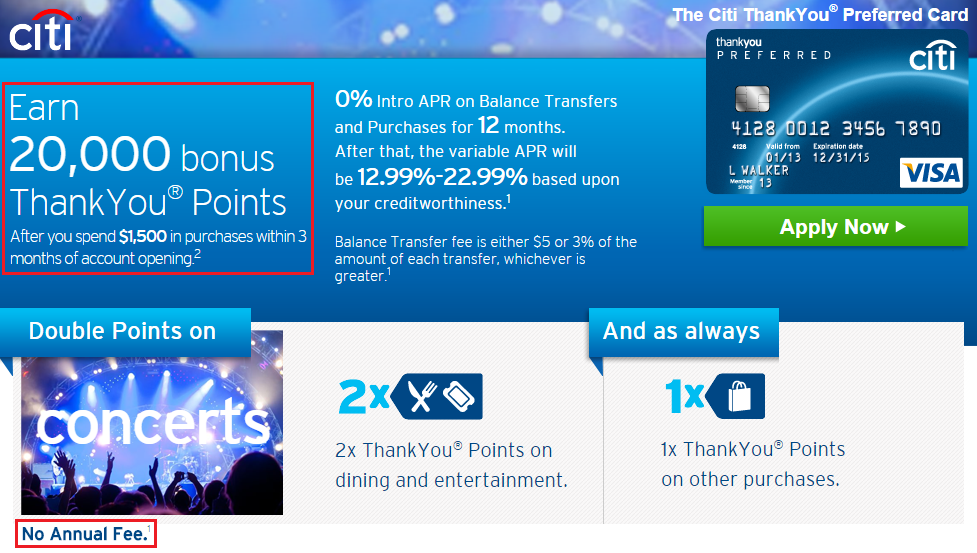

- Citi – I am currently sitting on 315,000+ AA miles and 2 Citi AA Executive cards, so I do not need any more AA miles. I already have a Citi Dividend Credit Card and Citi Hilton HHonors Reserve Credit Card. The only other offer that interests me is for Citi Thank You Points. The currently Citi Thank You Premier Credit Card is a bit deceiving since you have to spend $3,000 in the second year to get 30,000 Thank You Points, but then you get hit with the $125 annual fee. The Citi Thank You Preferred Credit Card offers 20,000 Thank You Points after spending $1,500 in 3 months, plus it has no annual fee. I will combine the points with my Citi Forward Credit Card.

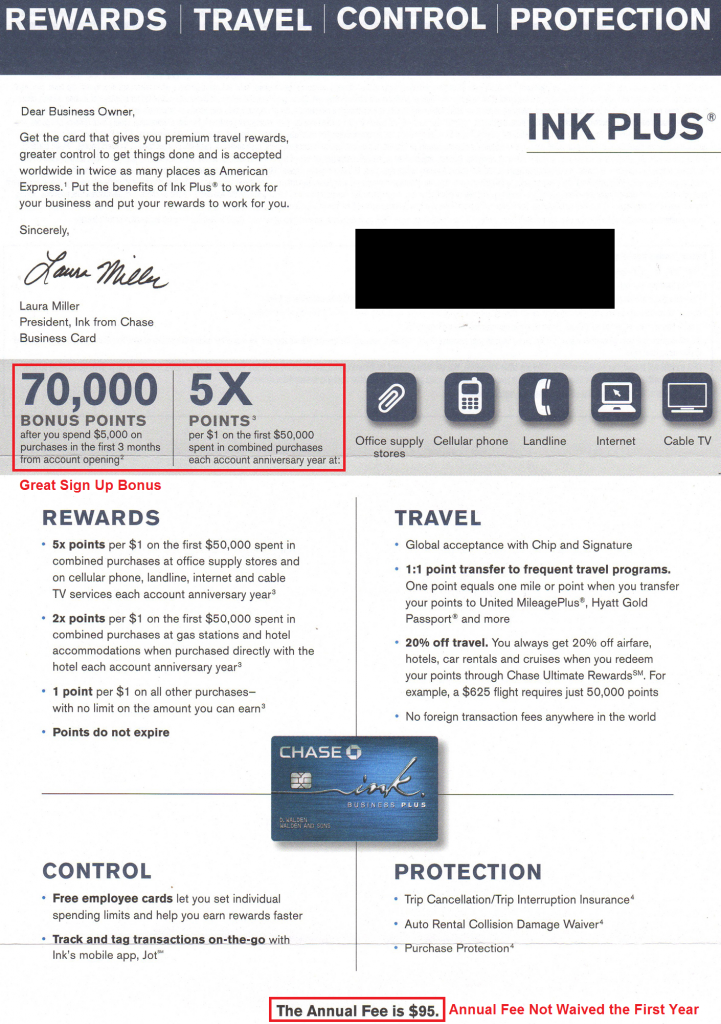

- Chase – I received a letter in the mail regarding the Chase Ink Plus Business Credit Card. It has the 70,000 Chase Ultimate Reward Points offer after spending $5,000 in 3 months. I currently have a Chase Ink Bold Visa and MasterCard, so I will probably have to make a recon call and explain why I need a 3rd credit card for the same business. “I want the flexibility and peace of mind to pay my card off over time.” I may have to close my old Chase Ink Bold MasterCard and/or my Chase Southwest Airlines Premier Credit Card.

- US Bank – I seem to have really good luck with US Bank. I have been approved for the Club Carlson Personal, the Club Carlson Business, and the FlexPerks Credit Card. If you have not be approved for US Bank credit cards, I recommend that you freeze your ARS and IDA credit reports. Follow these steps and you will be done. With that said, I think I will take a pass on US Bank for now. Maybe in mid December when I do my next App-O-Rama, some other offer will come up.

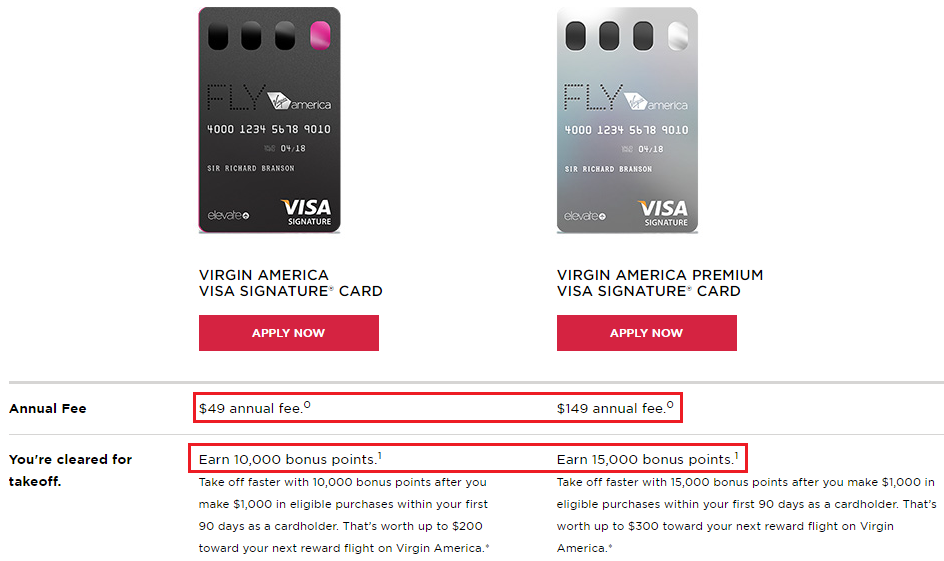

- Comenity Bank – more like “Comedy Bank” with these lame offers for Virgin America credit cards. $49 annual fee to get 10,000 Virgin America miles or $149 annual fee to get 15,000 Virgin America miles? No thank you to either offer. I will pass on Virgin America for now.

I am also helping my parents with some minimum spending on their new Chase United Airlines Credit Cards (spend $2,000 in 3 months) and my mom’s SPG Personal Credit Card ($3,000 in 3 months). Therefore, I do not need to go for many new credit card sign up offers. If you think I am missing any good offers, please let me know.

Thank you everyone for your feedback regarding my back to school blogger report card (link). If you have not answered the 3 poll questions, I would greatly appreciate your feedback and constructive criticism. Have a great week everyone!

Grant, hope you had a great weekend, couple questions:

“Bank of America Alaska Airlines Visa Signature Credit Card – automatically approved, but for a Platinum Plus credit card with a $2,000 credit line”====> which sign up bonus offer did you go for? 40,000 miles upon application with annual fee not waived?

“since I already have 3 Alaska Airlines credit cards (personal Visa Signature, personal Visa Platinum, and business)” ===> Is BofA card highly churnable? how long do you wait between each application to apply the next BofA card? do you still have all the 3 open until now?

Can you please upload the recon call result and recordings later when you done with it?

Thanks!

Good evening Amanda, I had originally applied for my second Bank of America Alaska Airlines Visa Signature Credit Card, but I was not approved for that card, so I ended up getting the Bank of America Alaska Airlines Visa Platinum Credit Card instead (it was all automated by the system).

You can keep applying for more Alaska Airlines credit cards. You do not need to close any open cards or wait a certain period before applying. I did not make any recon calls for this credit card.

I did apply for Alaska Airlines Visa Signature and got pending status and had to call recon line…was approved. Now it is still open, I paid the annual fee…..do you think it’s good idea to keep the card for 10 months and close before 2nd annual fee hits? And then apply for second card?

When you pay the annual fee for the first year, you are essentially buying the $99 companion certificate. How long have you had the card open? Instead of closing the credit card, I would convert the card to a Better Balance Rewards Credit Card.

Good news Grant. You can have both Blue Cash Preferred and Old Blue Cash at the same time.

Thank you Raul, do you know this first hand? If so, did you have the BCP first then go for the Old AMEX Blue Cash?

Yes you can have both. I had the new blue cash before I applied for the old Amex blue.

Hey Grant, not point in having both the amex old blue cash and new blue cash. The new blue cash earns less than 5% cb when you take into account the annual fee.

See if you can PC the new to the old.

I agree that you don’t need both cards. I will keep the BCP open until I max out the 6% cash back from grocery stores then I will close/downgrade the card. I don’t think the CSR will let me do a product change since that card is not officially available. Have you heard otherwise?

That’s correct I had BCP and couple months later i also got the Old Blue Cash. I disagree with Doctorofcredit I like having both. Plus if you take into account the $6500 u need to spend before getting the 5% back neither truly gets you 5% back.

Yes that is true. You will never get 5% cash back, regardless of how much you spend per year, but it will be very close.

hey Grant, i see that you were interested in Citi Thank You points, it very similar to Chase Ultimate Reward but few difference.

For Transfer points

Chase: 6 airlines (including 2 airline that Chase has a separate cards with Southwest and United), 3 hotels and 1 train.

Citi: 9 airlines (no AA) and 1 hotels (Hilton where transfer to Hilton is 1.5 point for every TY point)

I also believe both company requires you to have a credit card that has annual fee in order to transfer points to hotel/airlines.

one of the citi has a good advantage is that you can earn TY points if you have a checking count that get direct deposite, paying bills etc. i’m not sure about Chase Ultimate reward can do the same which i need to find that out.

My opinion is that its not worth it to have Citi Premier or Preferred TY cc if you already have Chase Sapphire preferred, Ink, and/or freedom and you have lots UR and no TY pts.

For some reason, my Citi Forward Credit Card has the ability to redeem TYP for flights at 1.25 cpp. I would probably use the TYP for that instead of transferring the points to the other programs. Only Singapore offers good value but I don’t even have a Singapore frequent flyer account.

Let us know any info on having old Blue and new Blue. I’m in the same boat. I’m almost positive it’s a different product and we can have one of each.

I’ll let you know on Friday morning or evening. *fingers crossed*

Two related comments – first, I was in a similar situation with Citi – full up at the moment with AA miles and already have the Dividend Select Visa. But I’m not overly interested in TY points right now.

I was doing a recon call on my AA Platinum MasterCard last month and unlike my AA Platinum Visa, they wouldn’t offer the AF credit, so I asked about downgrading to a Dividend Select MasterCard. It’s not promoted, and I couldn’t find it online, but the rep still had it in her system. I’m waiting on the 60 day conversion right now. So that would give me 2 x the $300 per year cash back in 5% categories. (I’m unsure if the Double Cash card will ultimately eliminate the DS cards altogether.)

Also on the 5% CB front, ever consider the US Bank Cash Plus? If you would be sitting out US Bank, it might be worth the trip to a local branch to sign up. I drove there first thing on a Saturday and applied online for my other cards in the afternoon.

I did both cards in my AOR last month, ultimately giving me the four big rotating 5% cards – Freedom, Discover, Dividend Select, and Cash Plus. Without international travel, I think 5% is pretty hard to beat. Plus none of the four have an annual fee!

I can’t remember if my Citi Dividend Select is MC or Visa, I will check tonight. I currently have 2 AA Exec cards and a AA Platinum card for the 10% rebate. I definitely do not see a future with those 2 AA Exec cards, so I will try the conversion to another Citi Dividend card. I really dislike the 60 day conversion waiting period for Citi Cards.

I have thought about the Cash Plus Card, can you only apply in branch and not online? I might downgrade my FlexPerks to the Cash Plus card.

I’m not a huge fan of applying for credit cards in branch, but that may be the only possible way going forward. Thanks for the suggestions.

I had read in some reviews that one apply for the US Bank Cash Plus card over the phone – if you are in a specific branch’s service area. If you are not, but apply anyway, that might cause a hard pull but eventually be denied. I am in the fringe area (by my reckoning), and although I have the two Carlson cards, I don’t have any deposit accounts, so I thought a face-to-face would minimize the possibility of problems. Took about 15 minutes while the computer thought … then approved. I had skipped this card for about three AOR’s before deciding US Bank wasn’t going to make it available for online applications again. By the way, I thawed the big three credit bureaus, but kept my ARS and IDA reports frozen.

Thank you for the data points. I live in SoCal so there are plenty of bank branches all over. I can’t believe my local Citi branch closes at 5pm otherwise I would check out the branch offers for their cards.

Grant, I received an Amex platinum in my email today for 60k MR w/ 5k spend in 3 months + 450 fee but i just applied for one from Ameriprise just last month so I have to pass. It has an RSVP code that I’ll be more than happy to give you, if you are interested.

I already have an AMEX Mercedes Benz Platinum so I am going to pass, but I appreciate the offer. Thank you Victor!

Barclays is a tough bank to get in good with. I applied for a US Air card years ago and was declined, but in July, I was approved for the Arrival+. I’m a bit torn about keeping the card. 2.22%+ vs. my main currency, UR?

I would definitely keep it until the annual fee comes due and ask for a retention offer.

I’m still in the learning curve here, so my question is why keep a card for the annual bonus (free night or lump sum of points, etc.)? Couldn’t you cancel a card and then re-apply in a year or so and get the (usually much better) new card bonus? Or maybe my thinking is wrong and you can apply for the same card multiple times without having to close the one that’s open already?

Also, when you call to cancel a card and they offer to downgrade you to a no-fee card, do you get the sign up bonus, if there is one, on the no-fee card?

I really like your blog! I’m getting ready for my second App-o-Rama myself.

Patty

Each credit card company has different rules about getting the sign up bonus multiple times and whether converting/downgrading credit cards are eligible for the sign up bonus.

Hi Grant,

From first hand experience, you can have both AMEX Blue Cash and Blue Cash Everyday. And no, you cannot do a product change to the AMEX Blue Cash since it is no longer being issued.

I actually ran into quite a bit of issue earlier this year when I tried to do a product change from BCE -> BC, the rep accidentally applied me for another BCE (with no sign-up bonus since I “applied” on the phone) and I somehow ended up with 2 BCE cards! I called maybe 5-10 times to complain and finally a manager said it’d be very difficult to reverse a credit inquiry so he will offer me $250 statement credit as a “sign up” bonus. I appreciate the manager’s gesture so I took the $250 and subsequently closed the “older” BCE and applied for another BC.

Hope that helps!

Good morning Jeff, glad you were able to get both the Old AMEX Blue Cash and the Blue Cash Everyday. I’m sorry you ran into trouble converting your Blue Cash Everyday card. Glad you got $250 out of it though.