Quick Thought: The US Bank FlexPerks Travel Rewards Visa might be the Worst Travel Credit Card Ever

I just got off the phone with US Bank and came to the conclusion that the US Bank FlexPerks Travel Rewards Visa might be the worst travel credit card ever. Why you ask?

Simple. Do you see that shiny chip on the left side of the credit card? That chip should signify that this card is made for international travel and ready to go. The only problem is… Foreign Transaction Fees!

I don’t know what is going through the minds of US Bank’s credit card management. Who would have foreign transaction fees on a credit card that was made for international travel. That is a sick joke, sick indeed!

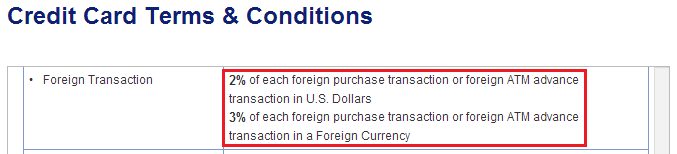

According to the terms and conditions of the credit card, all foreign transactions placed in US Dollars incur a 2% fee and all foreign transaction placed in a foreign currency incur a 3% fee.

Needless to say, this card is never leaving the country, let alone my credit card drawer at home. It is such a shame. Oh well, my Chase Hyatt Credit Card is my go to card for all foreign purchases (I cancelled my Chase Sapphire Preferred Credit Card a few months ago, remember?).

It is good to have credit cards from several different banks in case one card/bank stops working through your trip. It is also smart to call them before you start travelling so they don’t freeze your card. Lastly, bring your debit card too, but remember to call your bank and tell them about your travel plans.

P.S. I just got my shiny (not really) American Express Serve Card today, oh the possibilities…

AmEx has foreign transaction fees on a lot of their EMV enabled cards as well. Just get the bonus then downgrade to Cash+

Good point Will, always best to double check if the credit card has a FOREX fee before travelling.

And I thought the Bank Of America Travel Rewards card was the worst one.

Not even close. That card doesn’t have any FOREX fees. That was my first Bank of America credit card. RIP old friend…

Heck, Diners Club is chip AND PIN and adds foreign transaction fees.

That’s not technically a travel card though. But I see your point. Chip (and pin) should always come with no FOREX fees. It’s that simple.

How are you going to load serve now that cvs is cash only?

You can load serve online with credit cards and debit cards. Up to $1000 per month for each method. I’ll share more detail later.

But cash advance fees…

From what I have read online, online loads are not coded as cash advances. I will double check this.

From what I’ve seen in blogs, you can only have serve or bluebird. You opted for serve over bluebird giving up the benifits of loading gc at walmart?

Yes, but I still have my mom and dad’s Bluebird Cards which I can load at Walmart. But if I had one card, I would probably chose Bluebird.

First of all, how hard was it to convince your parents to sign up for Bluebird cards? Brain surgery is probably easier than convincing my parents to sign up for Bluebird cards. Also, isn’t it kind of unkind to use your parents’ Bluebird cards? You take away their own manufactured spending opportunities.

They don’t ask questions anymore. I just ask, what’s your SSN? And I got them each a Bluebird Card.

Trust me, that don’t do ANY MS at all.

I know my mom’s social security number. Do you think it would be rude to sign up for a Bluebird card in her name? If I do, then I would definitely give the card to her if she ever becomes interested in manufactured spending (which is nearly impossible). I still don’t know whether I should, though.

Just ask her. Hey mom, can I get a Bluebird Card in your name? It’s not a credit card, but it will help me rack up lots of miles and points. You don’t have to do anything.

There is not only US Bank that issues cards intended for travel and charges FTF. Look at Citi AA or the numerous Amex cards that also still come with EMV and FTF. The biggest disappointment for me is Amex (hotel or airline cards with FTF??) That is just as bad IMO.

First of all, why did you switch to Serve? Also, you say the US Bank Flexperks card isn’t a good card. However, they have a good 2X category bonus for grocery stores or gas stations, and a good 3X category bonus for charity. Also, I like that when it comes to redeeming Flexpoints, there’s always low-level award space available.

I switched from Bluebird to Serve last Saturday, right before the first CVS memo appeared online. The fact that I could load up to $5,000 at CVS with no load fees was very enticing to me. Now that CVS reloads are dead, I plan to only use online credit and debit card reloads.

i just wanted to say.. GRANT ILL TRAVEL WITH YOU ANYDAY. just felt like saying that after a long day in the library!

Thanks Eric, where are you now?

The flexperks points are challenging to use sometimes, but I’ve been able to rack up a huge amount of them doing MS in its bonus categories.

I agree that it isn’t a good card to use on international travel.

Do you mainly use the FlexPerks card at Grocery Stores?

I buy $500 visa gift cards at grocery stores to earn 2x points. I also use it to earn 3x on Kiva loans (the charity category).

I might buy the $500 Visa Gift Cards at my local grocery store to get to the 40,000 FlexPerks level.

Pingback: Lesser Known Perks of the US Bank FlexPerks Travel Rewards Credit Card | Travel with Grant

Pingback: US Bank FlexPerks: No Foreign Transaction Fees, 1,000 FlexPoints for Joining Visa Checkout, 3,000 FlexPoints for Spending $5,500, and other Offers (Targeted?) | Travel with Grant